Ahow Does a Differential Work Again

Image source: Getty Images

Your business may benefit from incentivizing employees to work late hours, but be sure to have a clear and consistent policy to handle it.

Imagine working on a difficult project for a difficult customer. At every step along the way, the client has added more requirements and pushed for earlier completion. Now you're down to the final week, and there's no way you can get everything done without some people working through the night.

Employees may be happy for extra hours, but they won't be happy having to be at work at 10 p.m. How can you sweeten the pot for those who stay late?

In this article, we'll go over how to do payroll for night shift work. We'll discuss when a night differential is required, how much the pay increase should be, and how to calculate it.

Overview: What is night differential?

Night differential is an increase in pay to compensate employees for working night shifts. Employees will receive either an absolute increase in pay per hour or additional money calculated as a percent of base pay in exchange for working graveyard shift hours.

Shift differential pay is different from the basic pay that goes to night shift workers. Employees who always work third shift and are paid more receive what is called "night pay" because they do not have a different base pay that is increased during night hours.

Night differential, on the other hand, goes to employees who only occasionally receive extra money for working shifts between certain hours. There is actually no night shift differential law in the U.S. for private companies.

According to the U.S. Department of Labor, "Extra pay for working weekends or nights is a matter of agreement between the employer and the employee (or the employee's representative). The Fair Labor Standards Act (FLSA) does not require extra pay for weekend or night work."

What are the special situations related to night differential?

If you decide to use differential pay for night shift work, there are a few special situations to keep in mind:

- Holiday pay: Holiday pay is generally 1.5 or 2 times normal pay. Determine if the night shift differential will increase holiday pay and if employees who are normally scheduled to work the night shift but get it off for a holiday will be paid their base pay or the night shift differential.

- Travel: Traveling for work can be onerous, and flight delays or road work can sometimes push the travel time into night shift territory. Decide if this situation qualifies for night shift differential pay.

- Offering extra vacation: Instead of increasing pay for night work, you could offer to accrue extra hours of vacation for every hour worked at night.

How to calculate night differential

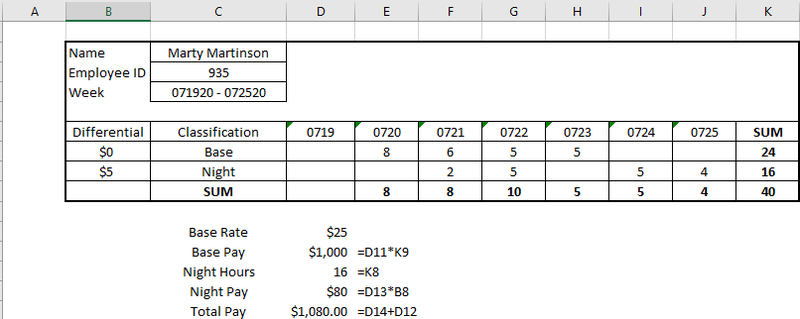

Let's work through an example of night differential. Marty Martinson typically works from 9 a.m. to 5 p.m. for LP Security. Lately the company has had some issues with attendance, and because Marty is the most reliable employee, it has had to move him around to make sure the most important shifts are covered.

Marty typically makes $25/hr and has a differential pay of $5/hr for night shift work. Here's what his timecard looks like:

Marty worked 16 total night shift hours, which added $80 to his paycheck. Image source: Author

Marty worked a total of 16 night shift hours for this week. To calculate his night shift differential, first calculate his total base pay:

40 hours x $25/hr = $1,000

Next, multiply the night shift hours by the night shift differential to find the total night shift pay:

16 hours x $5/hr = $80

FInally, add the night differential to his base pay for the total pay:

$1,000 base pay + $80 night differential = $1,080 total pay

Payroll deductions are based on the total pay. This process is fairly simple, and your payroll software should be able to calculate it automatically.

For salaried workers, use the same formula to calculate the differential pay. Start by calculating the implied wage per hour by dividing the employee's salary by 52 to get the salary per week and then by 40 to get the salary per hour.

If you set the differential at a percentage of pay, use that per-hour number. Alternatively, if you use an absolute amount per hour, like with Marty Martinson, you can simply multiply that amount by the night hours worked and add it to the salary for the pay period.

Why pay night differential?

Since there is no law requiring night differential as part of the payroll process, you could certainly get away without paying it.

However, all else being equal, the majority of your employees will see night shift work as more difficult to deal with. If they are scheduled for night work with no bump in pay, they may start looking for normal day shift work elsewhere.

Eventually, you will only be able to schedule employees for night work if they couldn't find a better job.

The $80 increase in the above example may not seem like much, but it adds up. If you make an extra $80 for 20 weeks out of the year, that's $1,600 straight into your bank account. For a lot of people, that is several months of car payments or two months' rent.

How do I institute night differential?

If you don't currently have a night shift differential policy, but you have night work planned, start thinking about instituting one.

The key is consistency. Set strict policy guidelines for which hours earn the differential and stick to those hours. Likewise, set a general standard (or a standard based on employee classification) for the additional pay and stick to it.

Even if you aren't playing favorites, any hint that some employees earn different amounts because of careless application of differential pay can lead to malcontentment among your staff.

Additionally, make sure to schedule work empathetically. Whenever an employee works late into the night, they need a day or two to recover before working the day shift again.

You can choose whichever hours and pay differential you think works for your company. A good example to go by is the federal government's night differential pay program.

How does the federal government do night differential pay?

According to the Office of Personnel Management, federal employees earn an extra 7.5% for working between 3 p.m. and 11 p.m. and an extra 10% for working between 11 p.m. and 8 a.m.

The government does not pay the differential per hour worked in those time periods. Instead it pays it for the whole shift if the majority of hours worked for the shift take place in the period.

For example, if an employee worked from 2 a.m. to 10 a.m., their entire pay for the shift would be increased by 10% because six of the eight hours they worked took place during night work hours. If the hours worked were from 6 a.m. to 2 p.m., there would be no differential.

Additionally, when employees are assigned to a normal shift that takes place during night hours, any holiday, vacation, or travel pay will be calculated based on their normal scheduled shift.

I wear my differential sunglasses at night

No matter how well you plan ahead, you may sometimes need to hold employees over through the night shift. An easy way to keep employees happy when this happens is to add an incentive for working night hours.

Make sure to develop an easy-to-understand policy for how payroll works with night differential and keep it consistent every time it's applied.

Source: https://www.fool.com/the-ascent/small-business/payroll/articles/night-differential/

0 Response to "Ahow Does a Differential Work Again"

Post a Comment